How to Reduce DSO Without Losing Your Larger Clients

Apex Electronics thought they had it all. Clients came in droves. Orders were steady. The future seemed bright.

But a problem emerged, quietly at first. A few late payments. Nothing too concerning. They ignored it, assuming it was just a temporary issue.

Then it started to grow. Slowly. Invoices piled up. Weeks turned into months, and still, no payments. Clients offered excuses: “Cash flow issues,” “There’s a delay.” But no checks arrived. When they did, they were smaller than expected.

Suppliers began to call. “We want our money, now,” they demanded. The banks weren’t far behind. Their calls came more frequently, more urgent. “Pay up, or else.”

The panic started to set in. Orders slowed. Production lines became sluggish. Employees noticed the tension, whispering about the change. The leaders at the top felt it too. They had promised clients the world, but now couldn’t even deliver the basics. Complaints piled up. Emails went unanswered. Calls went unreturned. The once-thriving business was now teetering on the edge.

Apex was running out of options. Their future, once bright and promising, now seemed like a distant hope. They didn’t know how much time they had left. Would they turn things around in time, or were they already too far gone?

How to Reduce DSO Without Losing Your Larger Clients

Reducing Days Sales Outstanding (DSO) is crucial to maintaining healthy cash flow. But when your largest clients are the ones holding up payments, it’s a delicate balance to strike.

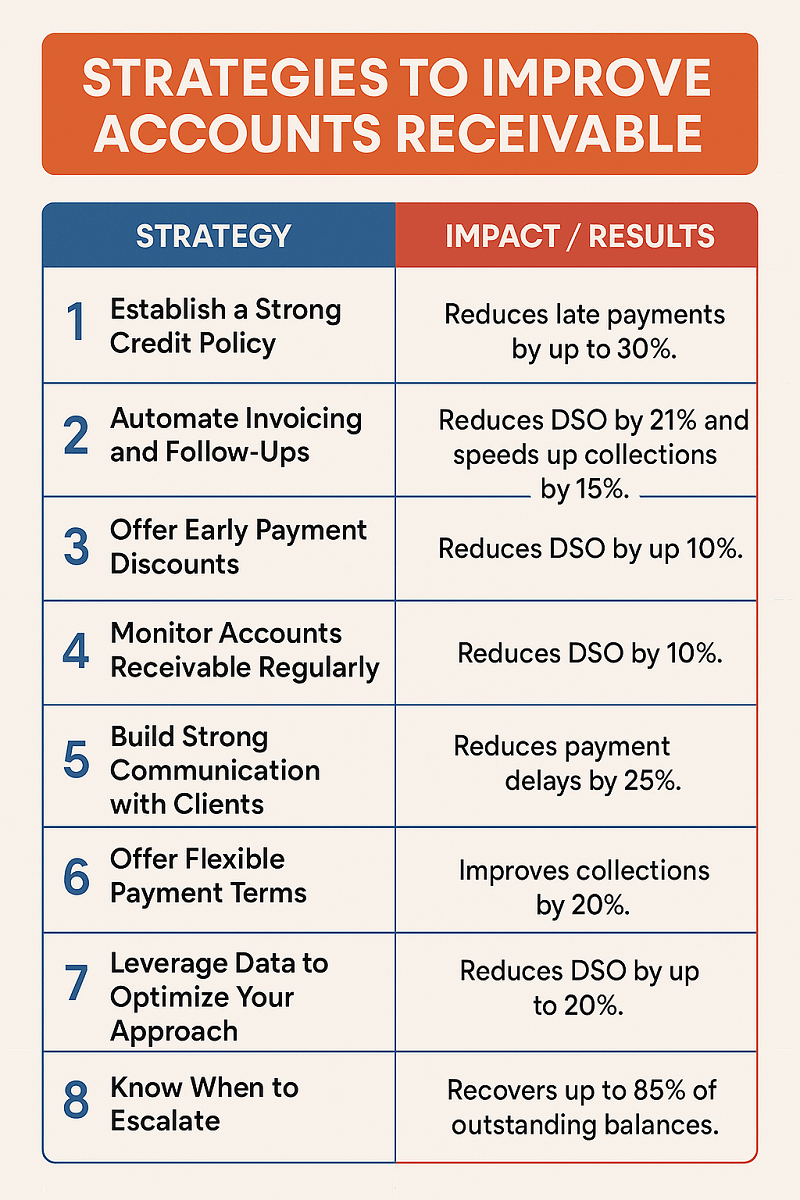

Here are the key strategies to reduce DSO:

- Establish a Strong Credit Policy

A clear credit policy sets expectations and minimizes confusion. Deloitte found that businesses with a strong credit policy reduce late payments by up to 30%. For example, a manufacturing company reduced its DSO by 22% by introducing a tiered credit system, offering better terms to long-standing clients.

- Automate Invoicing and Follow-Ups

Manual invoicing is inefficient and error-prone. Automating your invoicing system reduces delays and mistakes. Ardent Partners found companies that automate invoicing can reduce DSO by 21%. A SaaS company implemented automation and saw an 18% drop in DSO within three months.

- Offer Early Payment Discounts

Offering a small discount for early payments can encourage clients to pay faster. According to the Institute of Credit Management, businesses offering early payment discounts can reduce DSO by up to 15%. A consumer goods distributor increased early payments by 30% and reduced DSO by 12% with a 2% discount.

- Monitor Accounts Receivable Regularly

Regularly monitoring your AR ensures you spot overdue payments early. PwC found businesses actively monitoring AR reduce DSO by 10%. A European construction company decreased its DSO by 10% through weekly AR reviews and prompt follow-ups.

- Build Strong Communication with Clients

Regular communication with clients’ accounts payable departments prevents delays. McKinsey found that 70% of late payments are caused by miscommunication. A logistics company reduced payment delays by 25% by proactively contacting their clients’ AP teams.

- Offer Flexible Payment Terms

Flexible payment plans can help maintain liquidity and keep clients happy. KPMG found that businesses offering flexible terms see a 20% improvement in collections. A construction supplier used a six-month payment plan for a key client and reduced DSO by 17%.

- Leverage Data to Optimize Your Approach

Using AR data allows you to identify trends and potential issues early. Gartner reports businesses using AR analytics can reduce DSO by up to 20%. A retailer identified overdue payments from just five clients, reducing their DSO by 18% over a year by focusing efforts on those accounts.

- Know When to Escalate

If a client refuses to pay despite all efforts, it’s time to escalate. Harvard Business Review found businesses that escalate overdue payments sooner recover more money. One company recovered 85% of a large overdue balance within 30 days by turning it over to collections.

Turning Things Around

Apex Electronics took action. They implemented a strong credit policy, automated invoicing, and offered early payment discounts. Slowly, cash flow improved. Suppliers were paid on time, and the calls from the banks stopped.

The key clients, understanding the new structure, responded well. Relationships strengthened, and Apex learned that reducing DSO wasn’t about chasing payments—it was about setting a system and then managing it.

Consistency paid off. By staying proactive and using data to guide decisions, Apex regained stability and got back on the path to growth.